A Freelancer’s Guide: How to Register for VAT (Without the Headache)

- VAT

- Quick Read

A Freelancer’s Guide: How to Register for VAT (Without the Headache)

- Recent Thinking

- By Mike Smith

- Last updated on

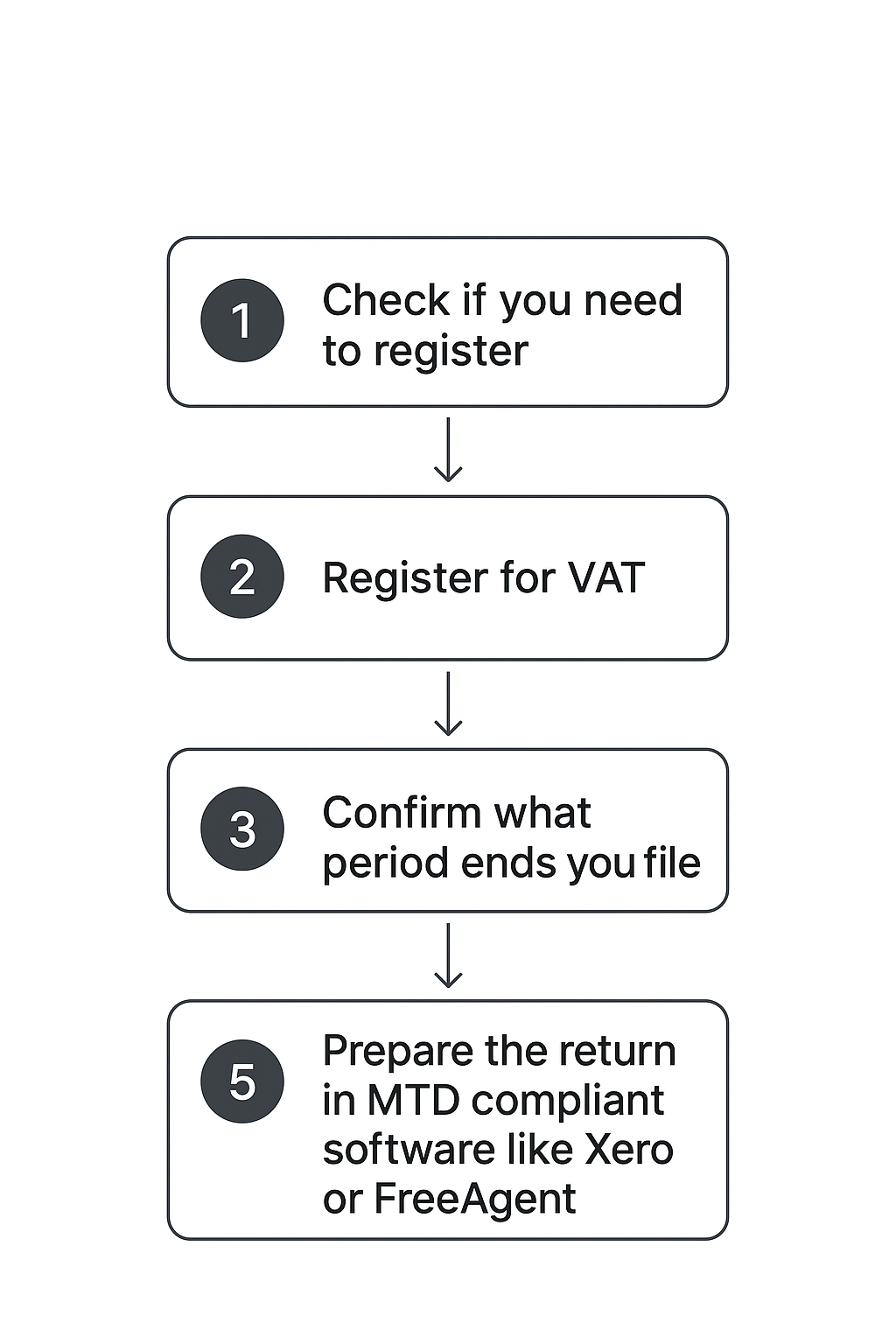

Your VAT registration checklist

So you’re growing your freelance business. You’ve got clients, bills to pay… and maybe now your turnover is creeping towards that VAT threshold. Or perhaps you want to be VAT registered voluntarily because you see advantages.

Either way, registering for VAT can feel bureaucratic. But with the right steps, it’s manageable — and with the right advice, you might even enjoy better cash flow, credibility, and more business opportunities.

Below is a detailed, numbered step‑by‑step guide to help small business owners and freelancers register for VAT in the UK — along with what to watch out for, what you’ll need, and what to expect afterwards. Think of this as your VAT registration checklist.

Why VAT Registration Matters

– If your taxable turnover exceeds £90,000 in any rolling 12‑month period, you must register for VAT.

– Some businesses outside the UK or taking over a VAT‑registered company are required to register even if they aren’t near the threshold.

– Voluntary registration (when you are below the threshold) brings perks: reclaiming VAT on purchases, appearing more established to clients, and preparing for business growth.

What You’ll Need Before Registering

– Decide on your business structure (sole trader, partnership, limited company).

– Your Unique Taxpayer Reference (UTR).

– Basic business details: trading address, bank details, contact info.

– Estimates of your recent and expected taxable turnover.

– Decide which VAT scheme suits you best (standard, flat‑rate, cash accounting).

Step by Step Guide: Registering for VAT

1. Check if you need to register (or want to, voluntarily).

2. Gather the required information.

3. Create / sign in to your Government Gateway account.

4. Start the VAT registration application on GOV.UK.

5. Fill in all required sections carefully.

6. Select your VAT scheme.

7. Submit your application.

8. Wait for your VAT registration certificate.

9. Update your invoicing, pricing, and contracts.

10. Keep accurate digital records & comply with Making Tax Digital (MTD).

After Registration: What to Do & Stay On Top Of

– Submit VAT returns on time (usually quarterly).

– Reclaim VAT on eligible purchases to improve cash flow.

– Monitor your turnover & scheme suitability.

– Make sure invoices are compliant.

– If your turnover drops below the threshold, consider deregistering.

– Stay updated on HMRC changes.

Common Pitfalls to Watch Out For

– Mis‑estimating turnover and missing the deadline.

– Picking a VAT scheme that ends up costing more.

– Poor record keeping.

– Forgetting to update clients/invoices once VAT is active.

Final Thoughts

VAT registration might feel like just another administrative hurdle — but for many freelancers, it’s a milestone: a sign that you’re scaling, becoming more professional, taking your business seriously. When done properly, the benefits (reclaiming costs, appearing more established, getting bigger contracts) often outweigh the extra work.

If you’re unsure whether to register now, or want help deciding which VAT scheme is best for you, it’s worth talking to an accountant familiar with freelancers/creative sectors. The cost of getting it wrong can be greater than the cost of getting expert help.

We’re ready when you are.

👉 Get in touch with us today if you’d like tailored support with annual filing, tax compliance, or managing your limited company accounts, our team of friendly accountants is here to help.

Credits and thanks: HMRC

How can we help?

At CORNEL Accountants we offer our small business clients an all-inclusive and fixed fee basis for any work we do, always agreed up-front. Why not take a look at our typical packages and get in touch for an initial discovery call and explore how we can help you?

Disclaimer:

The content included in this blog post is based on our understanding of tax and company law at the time of publication. It may be subject to change without notice and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this post or guide.